Free cash flow calculator free#

While the total value may seem stable, each year's free cash flow shows the organization is relatively unstable, affecting whether investors want to place trust and money into an organization. For example, free cash flow can show an organization that made $40,000,000 in revenue over the last decade differences in its earnings for each year. An organization can also use the increased insight to determine whether the other companies with which it works send and receive payments fast enough to keep pace with the company and decide which to continue operating with and which ones it can end relationships.Īn organization can use the insight from free cash flow to determine whether its operations are stable. For example, an company may reinvest its cash into creating more productive operations. This is important because the organization can change how it uses money. Operating Cash Flow: Key Differences Benefits of using free cash flowĪn organization that uses free cash flow to determine its financial health can generate a better understanding of its economic health. Investors can then use that money to invest in other organizations or reinvest the money into the original organization with the intent for the organization to use it for other processes and operations. This value means investors can take $25,000 from an organization before it disrupts the regular operations of that organization. For example, if an organization has an operating cash flow of $100,000 and capital expenditures (CapEx) equal to $75,000, then you can perform the following calculation: Once you find the values for calculating the free cash flow of an organization, you can perform the calculation using the formula.

Free cash flow calculator how to#

Related: How To Calculate Cash Flow (With Methods and Example) 3. Using the values from these cash flows can help you find the amount of money an organization doesn't use for operations, and determine the amount of money an investor can withdraw from a company before it disrupts operations. This is an important part of calculating free cash flows because the operating cash flows show the amount of money an organization needs to continue its operations. You can find these values on the financial documents of an organization. Locate the cash flows from operating activities Related: How To Calculate Projected Cash Flow: Steps and Tips 2. However, these documents don't adjust for changes in working capital or non-cash expenses. You can also use an organization's income statement and balance sheet to calculate free cash flow because those two documents show the amount of money an organization earns and the number of expenses the organization pays during the same period. The most common document is the statement of cash flows from an organization because it already accounts for non-cash expenses and any changes in the working capital of an organization. There are several financial documents you can use to calculate free cash flow. Operating cash flow is the revenue an organization makes minus its operating expenses.Ĭapital expenditures are the money an organization uses to maintain fixed assets such as buildings, equipment or land.īelow are the steps you can use to calculate free cash flow: 1.

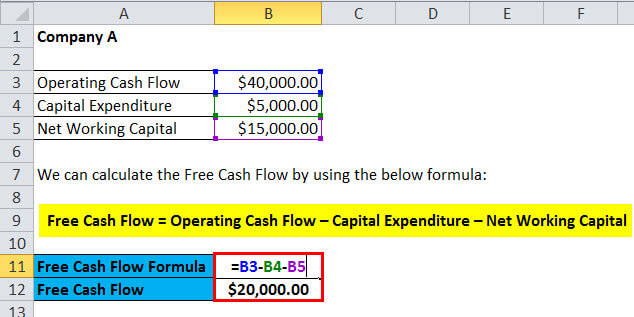

The most common method of calculating FCF is by using operating cash flow in the following formula:įree cash flow = operating cash flow − capital expenditures There are several ways to calculate free cash flow. Related: Guide to Cash Flow How to calculate free cash flow FCF is only the amount left after an organization spends cash to support daily operations and capital assets like land, property and operating machinery.

A positive or negative cash flow gives investors an understanding of how a company performs financially. The key difference between the two is that cash flow is the net amount of cash or cash equivalents cycling in and out of the company. Free cash flow is also called "free cash flow to firms," abbreviated as "FCFF." This number is helpful to shareholders interested in the amount of cash that an organization or investor can withdraw from an organization without disturbing operations.įCF differs from cash flow, which appears on the cash flow statement.

FCF is used to pay investors and shareholders. Free cash flow is the amount of cash an organization generates after it accounts for operational expenses and funds it uses to manage assets.

0 kommentar(er)

0 kommentar(er)